News

FINAL RULE ISSUED UNDER THE CORPORATE TRANSPARENCY ACT – IMPLICATIONS FOR THE SMALL BUSINESS OWNER

FINAL RULE ISSUED UNDER THE CORPORATE TRANSPARENCY ACT – IMPLICATIONS FOR THE SMALL BUSINESS OWNER

The U.S. Department of the Treasury Department’s Financial Crimes Enforcement Network (FinCEN) recently issued its…

AUDIT RISK TO INCREASE FOR LOW TO MIDDLE INCOME TAXPAYERS UNDER THE INFLATION REDUCTION ACT

AUDIT RISK TO INCREASE FOR LOW TO MIDDLE INCOME TAXPAYERS UNDER THE INFLATION REDUCTION ACT

The IRS estimates that individual taxpayers underreported their income tax on average by $245 billion…

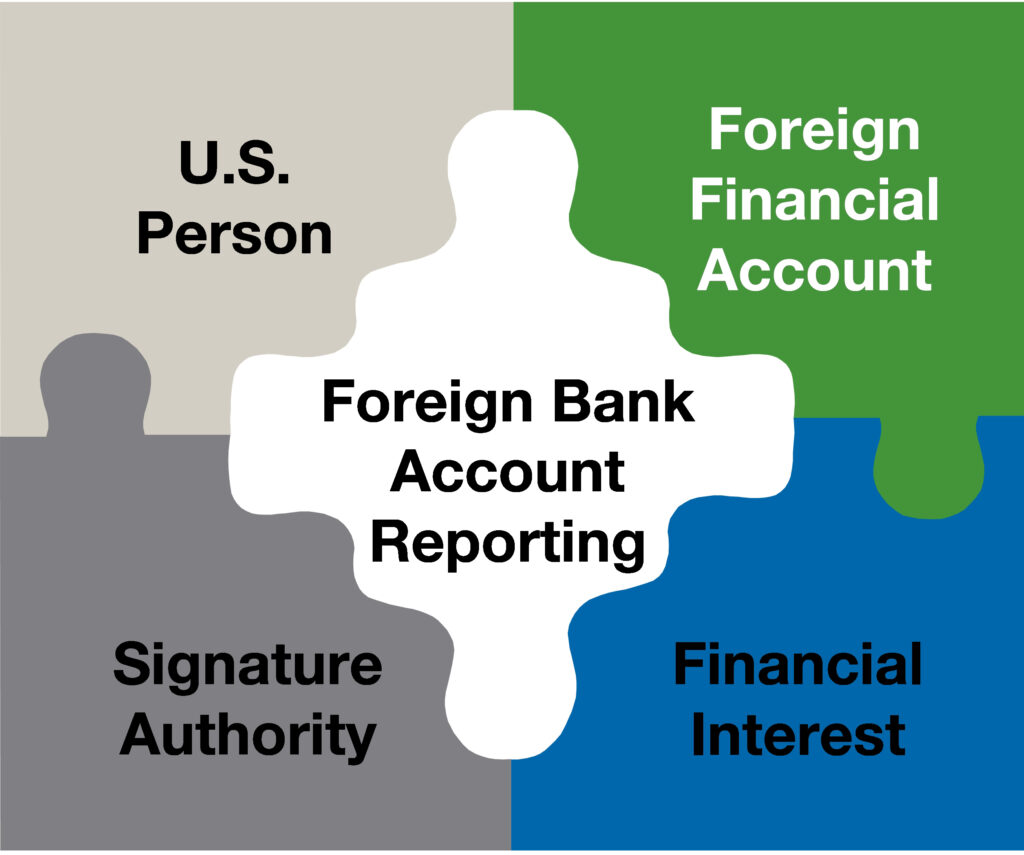

Quiet Disclosures and the Civil Willful FBAR Penalty. Even Death Will Not Help You

Quiet Disclosures and the Civil Willful FBAR Penalty. Even Death Will Not Help You

The Government will examine efforts by a Taxpayer to avoid detection by the Internal Revenue…

HOW BIDEN’S TAX PROPOSAL WILL IMPACT GIFT AND ESTATE TAX PLANNING

HOW BIDEN’S TAX PROPOSAL WILL IMPACT GIFT AND ESTATE TAX PLANNING

The Biden Tax Proposal, if enacted, will have a significant impact on estate planning for…

OVDP Coming to an End Soon

Internal Revenue Service plans to close the Offshore Voluntary Disclosure Program (OVDP) on September 18, 2018.…

New Developments in The Willful Civil FBAR Penalty

Current Developments May Make It Easier For the IRS To Assess Penalties After Willfully Failing…

Tax Evasion: No One Is Immune From Prosecution

The U.S Department of Justice, Tax Division:Federal Tax Prosecutions Continue Unabated Many taxpayers are skeptical…

The Liberal Elites: The Real Reason Why They Will Never Leave the USA

Why the Liberal Elites Will Never Leave the USA Despite Claiming Otherwise With the presidential…

Offshore Tax Compliance Prosecutions by the IRS

Offshore Tax Compliance Update – Recent IRS Tax Prosecutions The following convictions represent recent successful…

Delinquent IRS Trust Fund Taxes Update

The Trust Fund Penalty for Delinquent IRS Trust Fund Taxes If you owe back payroll…

FBAR Collections Ten Billion and Counting

IRS Releases 2016 Offshore Voluntary Compliance Statistics On October 21, 2016 the IRS released the…

Michigan Man Pleads Guilty To Tax Obstruction

“ANOTHER KNUCKLEHEAD BITES THE DUST” The definition of a Knucklehead is“someone considered to be of…